CPI

What today's CPI reading means for crypto

The February consumer price index (CPI) reading, an important inflation indicator, came in slightly above expectations this morning. This data point has considerable implications for risk assets like crypto. From the Wall Street Journal:

U.S. inflation was stronger than expected last month, introducing greater uncertainty over when the Federal Reserve will lower interest rates.

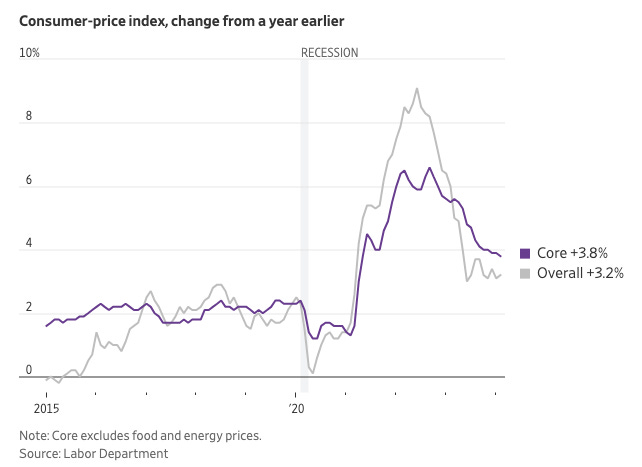

The Labor Department on Tuesday reported that its index of consumer prices rose 3.2% in February from a year earlier. Economists polled by The Wall Street Journal had expected 3.1%.

Core prices, which exclude food and energy items in an effort to better track inflation’s underlying trend, rose 0.4% from January—more than the 0.3% economists expected. Core prices were up 3.8% from a year earlier, and while that marked the smallest increase since 2021, the report dashed hopes that stronger-than-expected inflation in January was a mere blip.

Here’s a chart of CPI over the past year:

As seen above, overall CPI has decreased significantly from its peak of 9.1% in June ‘22. Despite the recent progress, inflation still has the potential to remain sticky above the Fed’s target of 2%.

Side Note: The Fed’s 2% inflation target is based on a separate price index from the Commerce Department. That index, known as the personal-consumption expenditures price index, or PCE, tends to run cooler than the Labor Department’s consumer-price index.

Today, Bitcoin and other cryptoassets trade like risk assets. Risk assets generally benefit from a healthy economy with low inflation and high employment. More recently, risk asset prices have been rising on the back of what Oaktree Capital Group refers to as a “Goldilocks” market:

The prevailing market narrative for the coming year demands a level of optimism that may be bordering on credulousness. The U.S. economy is expected to be neither too hot nor too cold, and the Federal Reserve is projected to begin cutting interest rates meaningfully without there being a recession or other crisis. In other words, everything is expected to be “just right.” While this could happen, we believe – to quote our co-chairman Howard Marks – that this all “smacks of Goldilocks thinking.”

The market has already revised expected interest rate cuts down from seven cuts in 2024 to three. Interest rate cuts, which tend to drive more liquidity into risk asset classes like crypto, could see further revisions down now that inflation has the potential to remain sticky. Fiscal dominance (see Lyn Alden’s recent post on the topic) is also playing a key role in bolstering markets at the moment.

From the crypt-native’s perspective, the recent meme coin mania in crypto and the upside surprise in ETF flows (from largely retail/individual investors) are perhaps leading indicators that the market is running too hot.

What does CPI mean for crypto? If CPI continues to be sticky and the economy is running too hot, the Fed is less likely to lower rates. Continued CPI surprises to the upside could make risk asset markets like crypto more skittish.

Keep in mind that the market has not reacted negatively to CPI so far. In fact, the market was up shortly after the CPI announcement this morning. It’s certainly possible (and even likely) that the Goldilocks market scenario will continue to play out. But risk asset investors should be watching CPI readings and related indicators like a hawk.

The irony of this scenario is that runaway inflation is precisely the problem that Bitcoin is designed to solve. In the long run, Bitcoin’s “digital gold” qualities should make the asset trade like an inflation hedge rather than a risk asset. This was also the irony of Bitcoin trading lower in the wake of the banking crises in 2023. Bitcoin is specifically designed to allow individuals to self-custody wealth rather than rely on third parties like banks.

However, today, Bitcoin is traded by speculators who want to ride the fastest horse in a risk-on environment. In the future, I anticipate Bitcoin will be appreciated for its quality as an inflation hedge, meaning high CPI numbers and the continued devaluation of the dollar should cause people to want to own more hard assets like Bitcoin and gold.

Regardless of the speculative, risk-on nature of Bitcoin markets today, Bitcoin investing is better approached from the long-term mindset of a hedge against currency debasement. Just ask Blackrock’s Larry Fink. Therefore, if CPI continues to come in hot and Bitcoin price sputters, one should view this as an opportunity to accumulate assets at lower prices to take advantage of the long-term opportunity.

If CPI continues to trend higher than expected, we may see these buy-in opportunities in the coming months. The Goldilocks scenario is also positive for those already exposed to cryptoassets – prices could just keep going up…