Google Search Indicators

What do Google Search Trends tell us about where we are in the current market cycle?

It’s often said in the crypto world that in a bear market, cryptoassets trade on fundamentals, and in a bull market, cryptoassets trade on attention. I’ve generally found this to be true. If it wasn’t clear already, we’ve entered a bull market environment where asset prices are flying up left and right based on attention and mindshare. The best examples of this are:

Bitcoin: Increased attention / mindshare / investor access as a result of the ETFs

Meme coins: Pure attention and mindshare value without any real fundamentals

AI coins: Generally a faux fundamentals narrative when really they’re just meme coins in a category (AI) that has growing mindshare across our society today

That’s not to say there aren’t cryptoassets that have real value and fundamentals. It’s more to say that the bull market is a time when attention and narrative can be the most important driving factors for token prices.

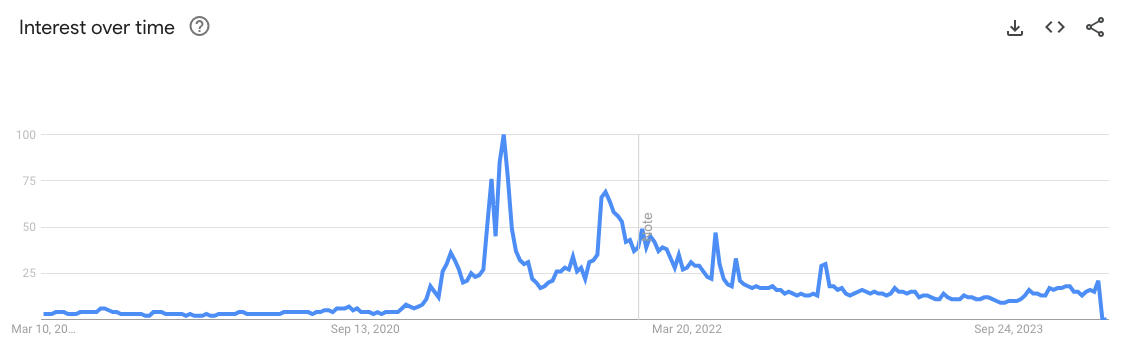

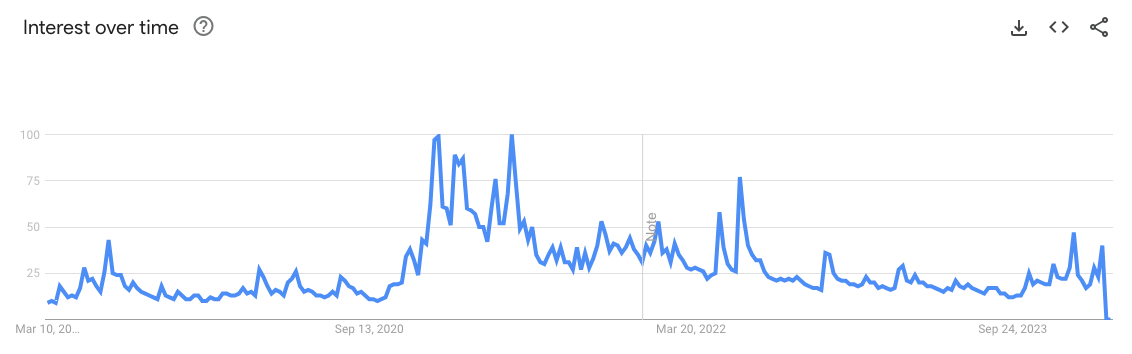

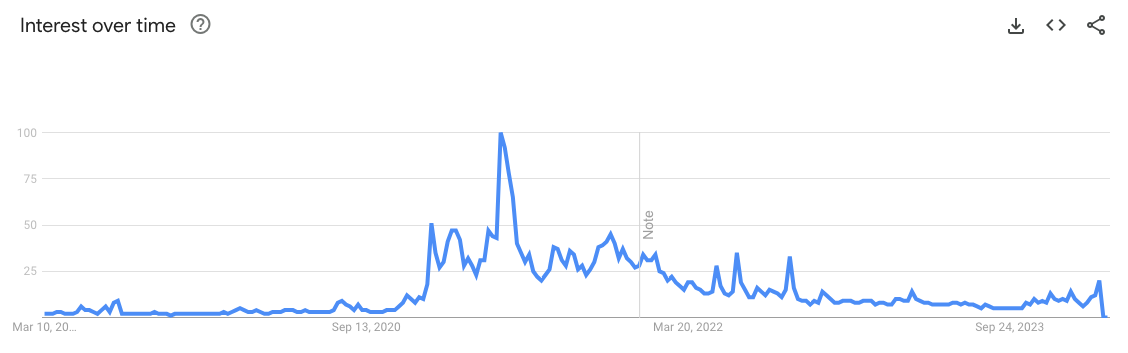

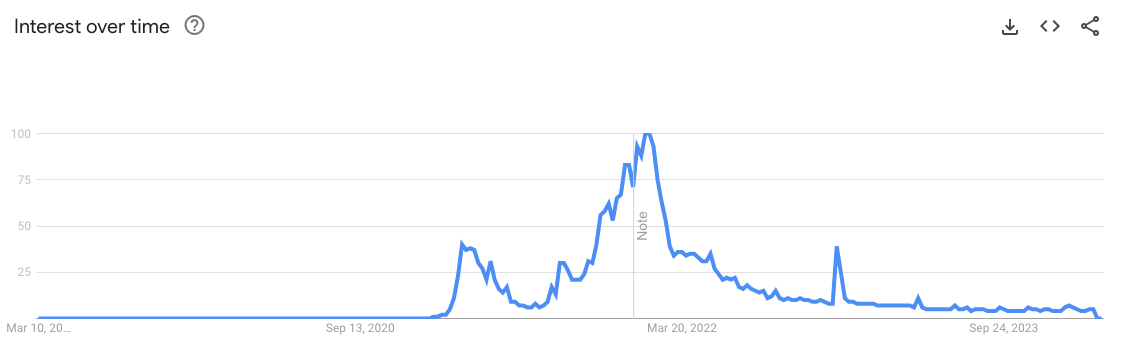

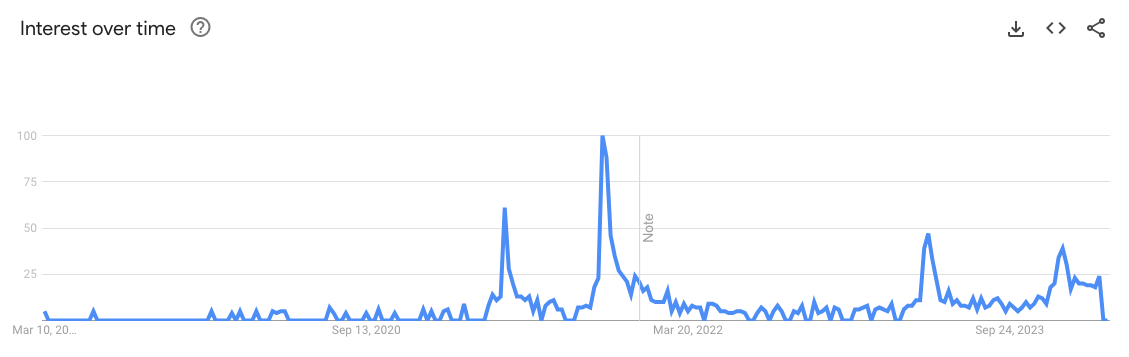

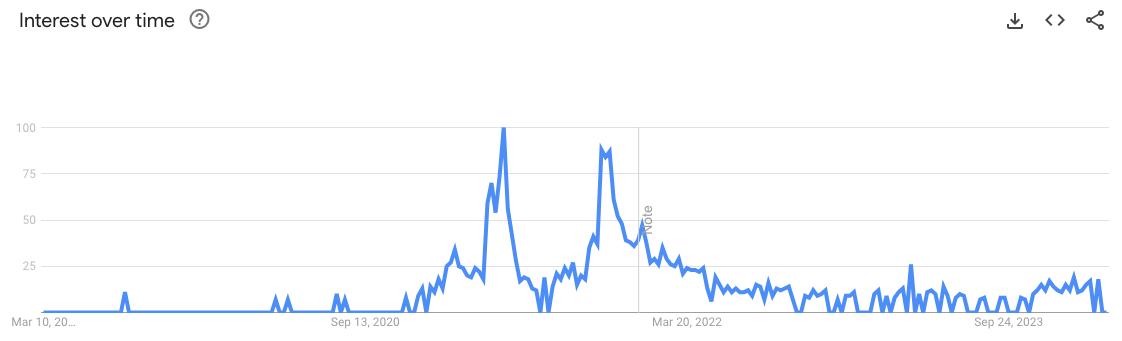

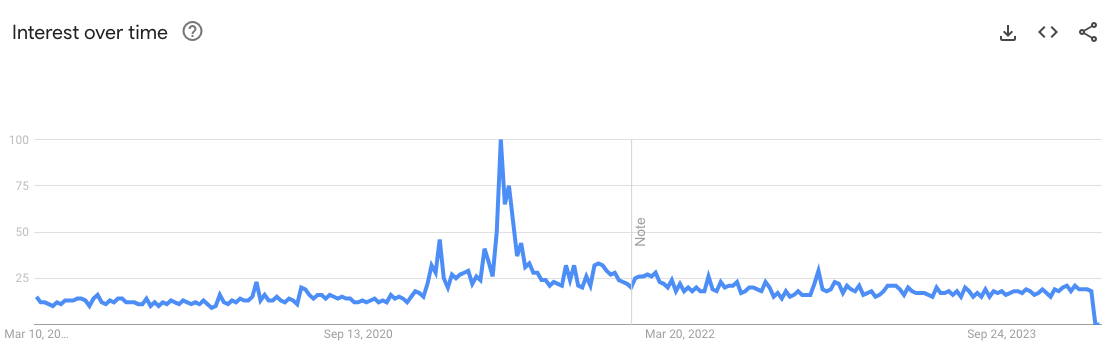

Google search trends are one of the best indicators for determining the state of attention and mindshare dedicated to crypto. Evaluating the search trends for the most popular crypto-related search terms can help us understand how advanced we are in the current cycle. See the charts below showing Google search trends for various crypto-related search terms over the past five years:

“Crypto”

“Bitcoin”

“Ethereum”

“NFTs”

“Meme Coins”

“Cheapest Crypto”

A good indicator for uninformed retail investors.

“FUD”

FUD stands for fear, uncertainty, and doubt and is typically a phrase used to dismiss concerns about crypto markets being over-extended.

As we can see, we’re nowhere near the peak crypto attention levels of 2021 for most search terms. Keep in mind that the peak search volume for these keywords in each subsequent cycle typically surpasses the search volume of prior cycles.

This indicates that despite the recent price runup, we still have a way to go before we’re at a cycle top.

Watch the search trends closely. As soon as these indicators start flashing, it might be time to rethink your position in the market. Not financial advice…